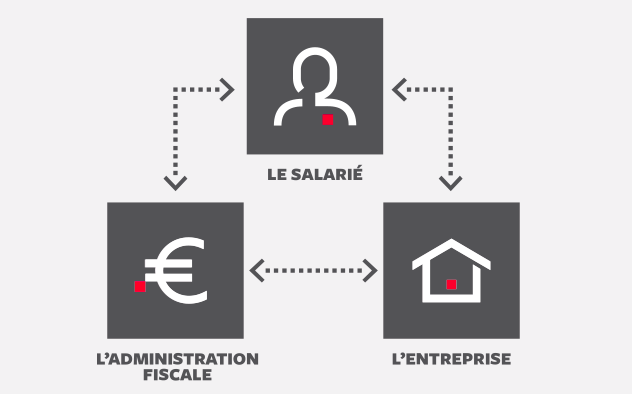

Après des semaines d’hésitation, il n’y a plus de retour en arrière : à compter du 1er janvier 2019, l’impôt sera payé au fur et à mesure de la perception des revenus. L' instauration du prélèvement à la source (PAS) ne se limite pas à une bonne gestion du prélèvement mais constitue un changement majeur que l'entreprise doit anticiper et sur lequel elle doit communiquer auprès de ses salariés.

Anticiper la réforme, c’est aussi envisager le traitement fiscal des revenus de l’année 2018, année de transition entre les deux systèmes, dite « blanche », lourde d’enjeux en termes d’imposition personnelle.

100% des entreprises en France sont concernées !

En effet, elles deviennent toutes collecteur de l’impôt sur le revenu dû par leurs salariés, et doivent anticiper :

- la gestion du changement pour les équipes en charge du projet PAS

- la gestion technique du prélèvement par les équipes paye

- la formation des équipes et l’information aux salariés

A qui s'adressent nos interventions ?

Direction générale

Sécuriser la démarche, rationaliser les coûts.

Services finance, comptable, paye, RH, DSI

Accompagner la transition, mettre en place les process et les outils, expliquer la démarche.

Salariés

Comprendre les impacts du PAS, choisir les options, décrypter le bulletin de paie.

Fidal est à votre disposition pour :

Vous aider à la mise en place pratique du PAS pour être prêt au 1er janvier 2019

- Détermination des revenus concernés par le PAS

- Modalités de prélèvement

- Analyse des incidences sur les stratégies de rémunération

Vous soutenir dans votre nouveau rôle de collecteur d’impôt et garant des justes prélèvements

- Obligations déclaratives pour l’entreprise

- Moyens mis en œuvre pour collecter l’impôt

- Impacts sur la paye

- Gestion de la confidentialité des données et relation avec l’administration

Vous accompagner dans la gestion de l'année blanche fiscale pour les revenus 2018

- Traitement fiscal des revenus 2018

- Revenu exceptionnel

- Impacts sur la politique de rémunération

Notre valeur ajoutée

Notre offre d'accompagnement modulable

Nos avocats interviennent auprès de vos équipes pour des sessions d'informations/formations à durée modulable

- Présentation du mécanisme de prélèvement à la source à votre Direction Générale, vos services RH, comptables et paye, et DSI, par 2 avocats des départements Fiscal et Social.

- La mise à disposition, sur site, d’un avocat fiscaliste et/ou d’un avocat en droit social/paye qui répondront, de manière confidentielle et sous forme d’entretiens individuels, à toutes les questions des salariés.